How Innovative Retirement Income Streams Compare to CPI-linked Annuities

Case Study: Exploring Outcomes for a 70-Year-Old Retiree

CPI-linked lifetime annuities offer predictable, inflation-protected retirement income for life.

In 2017, the Federal Government introduced a new category of retirement income products into the Superannuation Industry (Supervision) Act, known as Innovative Retirement Income Streams (IRIS). These products are designed to provide consumers with higher income, greater flexibility, and the ability to participate in investment markets — all while delivering income that cannot run out.

Which option delivers more for today’s retirees and what are the trade-offs?

To answer this question, let’s look at a 70-year-old retiree considering two lifetime income products. Both options are based on the same lump sum investment of $100,000. The retiree must weigh the benefits of security and simplicity against flexibility and potential upside or downside.

A snapshot of the results is set out in the table below:

| Snapshot of comparative incomes (per annum) | |||||

| Age | 70 | 80 | 90 | 100 | Total to 100 |

| IRIS Income* | 6,187 | 9,608 | 14,921 | 23,172 | 400,623 |

| CPI Linked Annuity ** | 5,908 | 7,600 | 9,728 | 12,453 | 273,075 |

| IRIS % Higher | 4% | 26% | 53% | 86% | 47% |

* Assumes 7% return net of product fees and levies. 2.5% hurdle rate

* Assumes CPI of 2.5%

Example $100,000 investment for a single 70-year-old male

The Basics: Two Pathways to Lifetime Income

1. CPI-Linked Lifetime Annuity

Most readers will be familiar with CPI-linked annuities. The income starts at a fixed amount and increases each year with inflation as reflected in the Consumer Price Index or CPI, providing regular, stable purchasing power for life. The insurer offering the annuity carries the investment risk, inflation risk and longevity risk. Insurers must use prudent assumptions and back these promises for life (which might be 40 years) with shareholders’ capital.

For retirees, CPI-linked lifetime annuities are typically considered as a secure, risk-free, inflation-linked income..

The CPI-Linked annuity option in our example uses a $100,000 investment that will pay a starting income of $5,908 per annum (1). The amount rises each year in line with increases in the Consumer Price Index, preserving purchasing power over time. It offers unmatched certainty but no exposure to investment markets.

2. IRIS Product

There is a range of different IRIS products now available (2). Unlike CPI-linked annuities, an IRIS unbundles the longevity insurance from the investment-guarantees. This allows products to be created that deliver lifetime income but still participate in market performance.

A typical IRIS works as follows: At commencement, the retiree’s lump sum investment is converted into an income stream, where the income level is recalculated each year based on the performance of an underlying investment portfolio, which is usually a number of investment options – as might be offered under an Account Based Pension or ABP. Just like an ABP, switching is allowed between these investment options. In fact, an IRIS can be described as an ABP with longevity protection.

The exact mechanics for how income levels adjust are defined in the product rules and will be set out in the Product Disclosure Statement.

The starting income is determined using actuarial factors based on the retiree’s age and life expectancy as well as a common feature known as the ‘hurdle rate’.

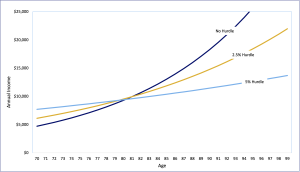

The chosen hurdle rate plays a crucial role in how most IRIS products operate. Chart 1 shows how a higher hurdle rate means a higher starting income level, but future income rises more slowly.

Chart 1: Investment-linked IRIS – Income shapes for different hurdle rate options

Source: ‘Comparing Lifetime Income Products Using Rates’, Retirement Edge April 2025

Importantly, the hurdle rate is not a fee. It’s a way of bringing forward some of the future expected income to enjoy higher income at the start of retirement when needs could be greater than later in life.

For this example, we will use the Generation Life LifeIncome product as the IRIS, which is also described as an investment-linked annuity. Our retiree is considering a 2.5% hurdle rate. It pays a starting annual income of $6,187 (3). Each year, the income is increased (or decreased) based on the net investment performance of the customer’s chosen investment option over and above 2.5%.

How Do Outcomes Compare Over Time?

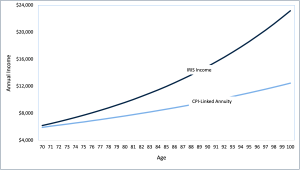

In Chart 2, we show a projection of income from the CPI-Linked annuity and the IRIS. It assumes inflation is 2.5% and investment returns (net of fees) for the IRIS are 7%.

Chart 2: Income Over Time – CPI-Linked Annuity vs IRIS

In the first year, the IRIS product offers around 4% more income than the CPI-linked annuity. Over time, assuming net investment returns of 7%, the IRIS income grows at an average of roughly 4.5% per year (7% return less the 2.5% hurdle), which exceeds inflation and results in an increasing real income.

By age 80, the IRIS annual income might be $9,600, while the CPI-linked annuity would have grown to around $7,615 if inflation is 2.5% p.a. That’s a 26% income gap in favour of the IRIS product, and the difference widens as time progresses but is subject to actual investment performance of the chosen IRIS.

What’s Driving the Difference?

The key difference in outcome lies in how returns are distributed:

- The CPI-linked annuity is priced conservatively. The provider guarantees the long-term income rates, applies conservative longevity assumptions, and holds relatively more shareholders’ capital for solvency. This security comes at a cost; resulting in lower starting income and less upside growth as the product must charge for the asset-liability mismatching risk — for example, in case CPI increases rapidly but the underlying assets do not perform as well.

This option suits cautious or risk-averse retirees who desire guaranteed income levels that don’t fluctuate over time.

- The IRIS product passes on the investment performance to the retiree, over and above the hurdle rate, less specific charges. Because IRIS products guarantee income for life, but the level of that income can vary, providers apply conservative longevity assumptions but don’t necessarily need to hold capital to guarantee the underlying investment performance – as the customer bears the investment risk.

This option may suit retirees who have at least a risk-tolerant risk profile.

In addition, some IRIS products allow switching between the available investment options by the annuitant — for example, to get out of or into equity-based investment options when equity markets are deemed high or low, respectively. This has been a drawback for advisers with traditional annuities, as they cannot advise on asset allocation, whereas now they can. Good financial advisers can align the investment mix within the IRIS with each client’s unique preferences, risk profile and circumstances.

But What About Downside Risk?

It’s important to recognise that the IRIS income in this example can go down in years of poor returns–if net investment returns are lower than the hurdle rate. For example, if the portfolio returns only 1% in a given year, income would likely fall by 1.5% (1% minus the 2.5% hurdle).

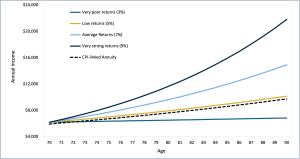

Chart 3: IRIS Income Under Different Market Scenarios

Even in relatively low long-term market conditions (say, 5% pa returns), the IRIS income might still outperform the CPI-linked annuity; however, this depends on the investment options the annuitant selects and switches into and out of.

Naturally the CPI and investment returns are never the same each year – as shown in this simple example. In practice they vary – and in that lies the opportunity to increase IRIS income by astute selection of investment options – to avoid market down-turns and benefit from market increases.

Conclusion: Getting More from Retirement Savings

For a 70-year-old retiree today, IRIS products offer a compelling alternative to CPI-linked annuities for at least risk-tolerant investors – even though the level of income may vary. They can deliver:

- Higher starting income

- Long-term growth linked to investment performance

- Ability to switch between the IRIS’s investment options – just like superannuation in the accumulation stage. If done well, this can increase the retiree’s income (or vice versa).

- Potential for greater efficiency and value

The income level comes with investment-related variability, but for many retirees — especially those comfortable with some exposure to growth assets — the trade-off is worth considering. Having a higher income to fund living expenses ought to increase lifestyle.

As retirement solutions evolve, the old dichotomy between absolute safety and full liquidity is being redefined. Retirees willing to accept some investment risk can now benefit from smart risk-sharing, greater efficiency, and more sustainable outcomes. IRIS products are a key part of his toolkit.

##

(1) Based on example rates published by Challenger on 13 May 2025 for a single male.

(2) Examples include Generation Life’s LifeIncome, Challenger’s Liquid Lifetime, ART’s Lifetime Pension and AMP’s MyNorth Lifetime. Allianz Retire+ offer a similar product with an investment performance floor and cap. For a full list, see www.retirementedge.com.au/providers

(3) Based on the Generation Life LifeIncome product with a 2.5% hurdle rate. Rates applicable as at 30 April 2025 for a single male. See the Product Disclosure Statement for full product details.