300 Years of De Moivre: The Father of Modern Retirement Planning

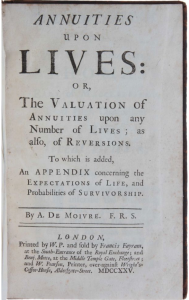

This year marks 300 years since Abraham de Moivre published a mathematical treatise that changed everything. His 1725 work laid the foundation for life insurance, pensions, and retirement planning as we know it.

From Refugee to Mathematical Pioneer

Abraham de Moivre was born in Vitry-le-François, France, in 1667. A Protestant (Huguenot), de Moivre suffered persecution following the revocation of the Edict of Nantes and was imprisoned for his faith at just 18 years old. He fled to England, where, despite poverty and professional barriers due to his nationality, he became a leading mathematician and was elected to the Royal Society in 1697. De Moivre’s circle included luminaries like Isaac Newton and Edmund Halley; it was Halley’s own work on mortality statistics that inspired de Moivre’s lasting contribution.

Abraham de Moivre was born in Vitry-le-François, France, in 1667. A Protestant (Huguenot), de Moivre suffered persecution following the revocation of the Edict of Nantes and was imprisoned for his faith at just 18 years old. He fled to England, where, despite poverty and professional barriers due to his nationality, he became a leading mathematician and was elected to the Royal Society in 1697. De Moivre’s circle included luminaries like Isaac Newton and Edmund Halley; it was Halley’s own work on mortality statistics that inspired de Moivre’s lasting contribution.

The Problem of Longevity and Annuities

There was a thriving market in annuities in London in the early 18th century. These contracts look similar to today’s annuities; people paid a lump sum in exchange for income payments for life. The problem was that these annuities were often sold without considering the buyer’s age. A 20-year-old and an 80-year-old might pay the same price for the same lifetime income stream.

Before de Moivre, mortality “tables” were little more than educated guesses. Providers might use crude rules of thumb—perhaps assuming everyone lived to the biblical “three score and ten”—or simply ignore age differences entirely. There was no systematic way to price risk, no mathematical framework for balancing individual needs with institutional sustainability.

The result was financial chaos. Governments and early insurance companies were gambling on human lifespans without any systematic way to calculate the odds—a situation that was clearly unsustainable.

The First Actuarial Textbook

de Moivre was scratching out a living in London, tutoring mathematics and calculating odds for gamblers. De Moivre recognised that the same probability theory being applied to games of chance could be used to tackle the uncertainty of human mortality. But unlike a roll of dice, human lifespans followed patterns that could be observed, measured, and predicted with mathematical precision.

de Moivre was scratching out a living in London, tutoring mathematics and calculating odds for gamblers. De Moivre recognised that the same probability theory being applied to games of chance could be used to tackle the uncertainty of human mortality. But unlike a roll of dice, human lifespans followed patterns that could be observed, measured, and predicted with mathematical precision.

Drawing from Halley’s life tables, the earliest systematic mortality statistics, de Moivre developed general formulas to calculate the present value of an annuity based on a person’s age and prevailing interest rates. He worked out both single-life and multi-life annuities and even tackled problems like reversionary annuities (which begin after another person’s death), tontines (group annuities), and inheritance calculations.

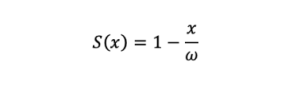

de Moivre’s breakthrough was creating a practical model that actually worked in the real world. At the heart of Annuities upon Lives was de Moivre’s hypothesis, now known as de Moivre’s law. He suggested that, for practical purposes, the probability of survival at a given age could be approximated as a straight line—declining evenly from birth to a notional “ultimate age.” In formal terms, this produces a simple linear survival function:

where S(x) is the probability of surviving to age x and ω is the ultimate age—the age at which survival drops to zero. To illustrate: if de Moivre set the ultimate age at 86 (as he often did), a 30-year-old would have a survival probability of roughly 65%, while a 60-year-old would have about 30%.

Although de Moivre himself acknowledged this was a rough approximation and modern actuarial science has refined this model considerably, it made calculations vastly more feasible in an era without calculators or computers. His method enabled rapid, replicable pricing of life annuities, making them more equitable for both insurer and purchaser.

Legacy in Retirement Planning

De Moivre’s innovations directly shaped the core products and concepts of retirement income planning:

- Fair Value of Annuities: His formulas allowed actuaries to price annuities according to both the age and interest rates, removing guesswork and ensuring sustainable, fair-value products essential for retirement.

- Joint and Reversionary Products: By extending his model to multiple lives and to payments that began after another person’s death, de Moivre’s methods laid the groundwork for today’s joint-life and survivor pensions, as well as modern survivor benefits and spousal annuities.

- Pension and Tontine Schemes: His analysis of tontines, which divided a common fund among survivors, contributed to the design of group pension schemes—a concept with echoes in today’s public and private pension plans.

- Actuarial Science: Annuities upon Lives is recognised as the world’s first actuarial textbook, standardising the methods for valuing life-contingent products and influencing actuarial practice for centuries.

Contemporary Applications and Challenges

De Moivre’s work addressed the twin pillars of retirement planning: risk and longevity. He showed that statistics and economic reasoning could work together to solve real problems. His methodical approach to uncertainty still offers the best template for handling today’s complex risks..

Technology has dramatically expanded what we can analyse, but the basic challenge hasn’t changed. We’re still using available data to make the best decisions about uncertain futures. Today’s financial models use sophisticated stochastic modelling, Monte Carlo simulations, and machine learning, but these tools are doing what de Moivre figured out three centuries ago.

A Lasting Commemoration

On the 300th anniversary of Annuities upon Lives, de Moivre’s achievements deserve more than academic celebration. They provided the intellectual infrastructure for life insurance and retirement planning—a framework that, to this day, empowers people to live not only longer, but with dignity and confidence that their financial needs will be met for as long as they live.

De Moivre’s legacy goes way beyond annuity tables and actuarial formulas. Right now, demographic change, market volatility, and technological disruption are challenging traditional retirement models. His work reminds us that sustainable solutions need mathematical rigour, not wishful thinking.

What made de Moivre special wasn’t just the maths—it was showing that you could turn life’s uncertainties into problems you could actually solve and fund. He didn’t just create formulas. He created confidence. Generations of people have faced uncertain futures knowing their financial needs would be met, and that peace of mind started with his work. As we figure out what retirement looks like next, that insight matters more than ever.