A Critical Evolution

in Retirement Planning

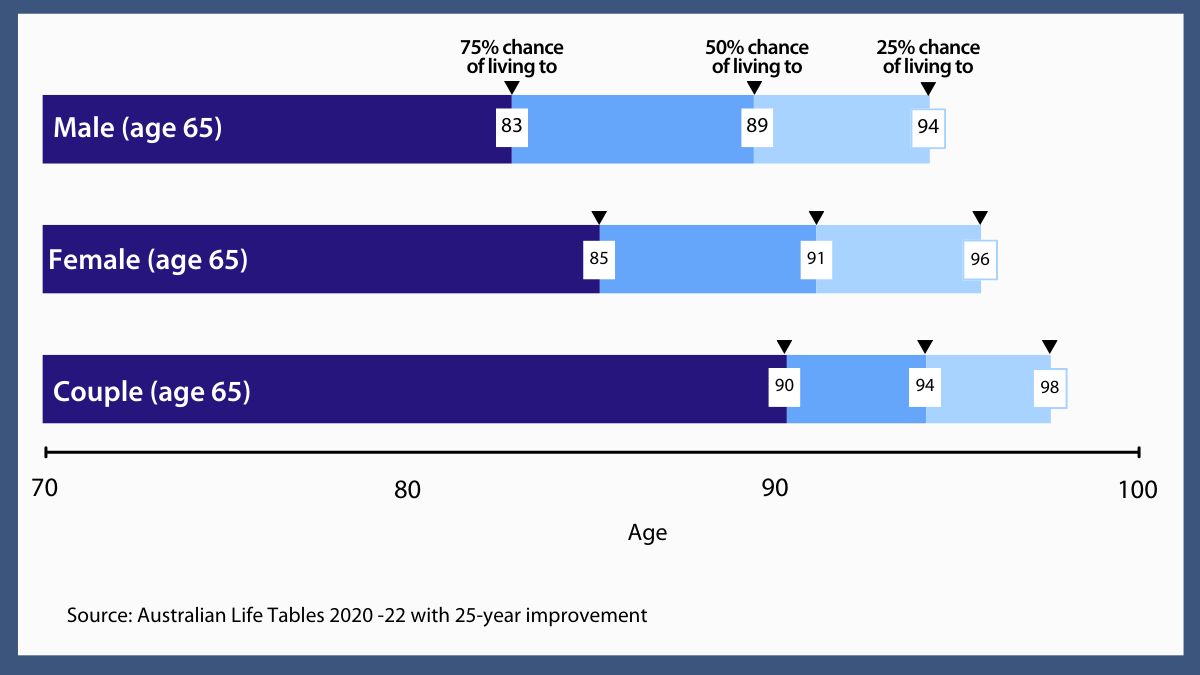

The average Australian can expect to live 5-10 years longer than their parents. While this is great news, it creates new challenges for retirement planning.

Our research shows traditional retirement planning approaches based on life expectancy estimates are no longer sufficient for effective retirement planning and risk management. In fact, the biggest retirement risk in funding retirement isn’t market volatility – it’s running out of money too soon!

LATEST DATA

OVER5MILLION

OF AUSTRALIANS UNDERESTIMATE THEIR LIFE EXPECTANCY BY 5+ YEARS

LATEST DATA

OVER5MILLION

BILLION

IN RETIREMENT SAVINGS EXPOSED TO LONGEVITY RISK BY 2030

LATEST DATA

OVER5MILLION

OF SUPER FUND MEMBERS EXPECT GUIDANCE ON

LONGEVITY RISK

Why Traditional Strategies Fall Short

The Drawdown

Dilemma

Super Savings Won’t Last Forever – Research shows retirees either withdraw too conservatively, compromising lifestyle, or too aggressively, risking long-term security.

Beyond

Market Risk

Investment returns fluctuate, but expenses don’t. A market downturn early in retirement can shrink savings faster than expected.

The Lifespan

Misconception

Studies indicate most people underestimate how long they’ll live, leading to potential financial shortfalls in later years.

Challenges

FOR RETIREES

- Conservative drawdown strategies impacting retirement quality

- Account-based pensions alone may not provide adequate protection

- Difficulty quantifying late-life healthcare cost provisions

Challenges

FINANCIAL ADVISERS + SUPER FUNDS

- Rising fiduciary responsibility for longevity protection

- Increasing demand for guaranteed income solutions

- Client/Member retention through retirement phase

A Smarter

Path Forward

The retirement income covenant has intensified focus on comprehensive retirement income solutions. Our research shows that integrating lifetime income into retirement strategies can help remove the guesswork, ensuring retirees receive guaranteed income for life—no matter how long they live.

By considering including innovative lifetime income products, financial advisers and superannuation funds can help Australians retire with confidence, security, and peace of mind.

Articles about Longevity Risk + Solutions

Take the Longevity Challenge

Research shows most people underestimate their longevity by 5-10 years. Use our Lifespan Calculator to access evidence-based projections and have more informed discussions about retirement planning.