Why Women Face Higher Retirement Risk – and What You Can Do About It

The Longevity Gap

Women, on average, tend to outlive men and often have lower career earnings and savings. They may also be more risk-averse investors. This combination creates unique financial challenges for women in retirement.

The greatest of these challenges is that women are at a higher risk than men of outliving their retirement savings, particularly given the increased healthcare and living expenses in advanced age. This highlights the limitations of traditional retirement savings, which can expose retirees to significant risk. Therefore, it’s crucial to consider lifetime income products, such as annuities. These products offer a wider range of options to mitigate these risks.

For risk-averse retirees, fixed annuities guarantee investment returns or increase rates (e.g., CPI) and provide an income stream for life. Cautious to balanced investors can consider investment-linked lifetime annuities, which offer a range of investment options and the flexibility to adjust them as circumstances and risk tolerances change. For couples planning retirement, joint lifetime annuities can utilise both partners’ savings, ensuring women benefit from their partner’s savings and enjoy greater financial security.

Lifetime annuities provide an income stream that is guaranteed to last as long as the individual lives. This helps to offset “longevity risk” – the risk of outliving one’s savings – offering financial peace of mind in later years.

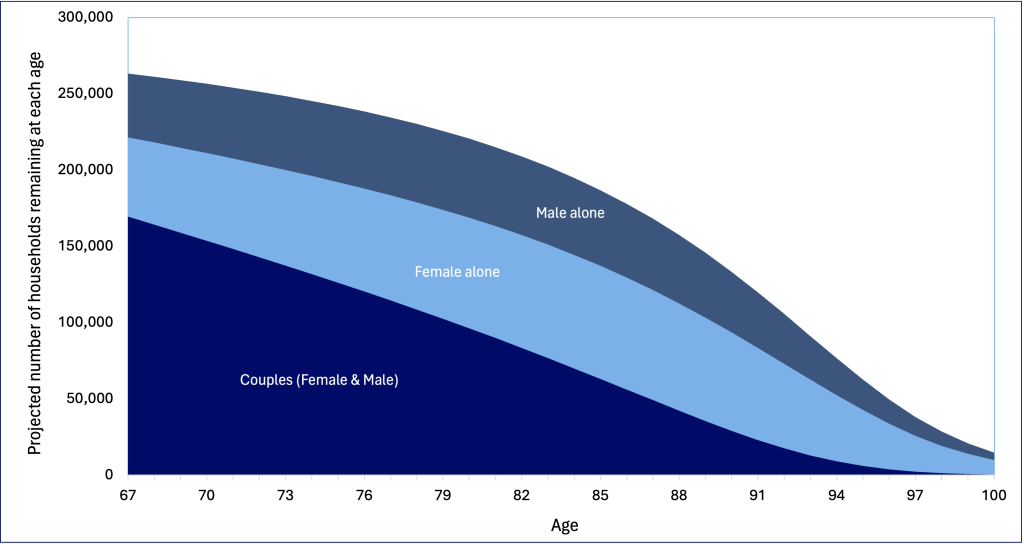

Currently, in Australia, there are about 42 thousand single males, 52 thousand single females, and 170 thousand couples aged 67. Based on data from the ABS and the Australian Life Tables, the number of couples will substantially decrease over time, while the number of single men and women will rise due to death and separation.

Chart 1: For Australians now aged 67, the projected number of households remaining at each age

This trend means many women will face longevity risk alone in their later years.

Financial Challenges for Women

Understanding these demographic trends is crucial for financial advisors as they consider the specific needs and perspectives of their clients, particularly women, in retirement planning.

Financial advice primarily focuses on metrics such as net worth, net returns, and asset allocation. These are the topics financial professionals are trained to emphasise. However, for many women, money represents more than just numbers. It is tied to their sense of security, confidence, independence, and the ability to live comfortably in the future.

Approximately one-third of newly retired women are projected to live past age 94, whereas only 17% of their partners are projected to remain with them. For couples entering retirement today, in about 60% of cases, the woman will outlive the man.

Chart 2: Household Gender as People Get Older (Projection of today’s 67 year olds)

The Role of Financial Advice

Given the importance of gender equity, especially considering the career sacrifices women make when raising families (e.g., reduced superannuation benefits), solutions and policies that benefit women provide extra security in retirement and help to mitigate pressure on the Age Pension.

To avoid poverty in old age, retirees should consider lifetime income sources such as lifetime annuities, lifetime pensions, or the Age Pension, all of which guarantee income for life.

Another important consideration for retirees is having income that broadly keeps pace with inflation, rather than declining and potentially ceasing altogether. Therefore, women planning for retirement must ensure they have sufficient income to maintain a good standard of living if their partner dies or they separate.

Having a regular income in our later years, when we may not be as confident or cognitively sharp as we once were, can provide significant peace of mind.

Lifetime Income Solutions

For those retiring as a couple, joint lifetime annuities can protect both partners from longevity risk by providing income for life, regardless of who dies first.

These products also provide automatic budgeting, with income typically deposited directly into a bank account each month, which can help manage spending alongside accumulated savings.

Furthermore, lifetime annuities offer a degree of protection against scams and fraud, as the asset is essentially “an income for life,” adding another layer of security for vulnerable older adults

As the retirement phase of superannuation matures, and longevity products and advice solutions evolve, women could take centre stage.

When it comes to how we view our retirement as couples, we should renew our vows to say not ‘until death do us part’ but instead ‘until the last of us leaves this planet.’

This article is general in nature and is not intended to influence readers’ decisions about investing or financial products. Readers should always seek their own professional advice that takes into account their own personal circumstances before making any financial decisions.