APRA Prudential Standard SPS 515: Right Member, Right Outcome

APRA has finalised its requirements for how superannuation funds will need to assess the outcomes they deliver to their members. It has released Prudential Standard SPS 515 Strategic Planning and Member Outcomes and one of two supporting practice guides, SPG 515 Strategic and Business Planning.

APRA is developing a heat map approach to look at how every member cohort/product is performing against a range of measures for quality outcomes that are in members best interests. The objective is to lift industry practices and drive improvement in the way super funds help all cohorts of members achieve their varying retirement income objectives[1].

Substantial changes have been made to the second practice guide, SPG 516 Outcomes Assessment. This has been renamed SPG 516 Business Performance Review and released for further consultation.

Funds have discretion to determine cohorts to best reflect their membership, so long as all members are covered in at least one cohort. APRA suggests considering things like age, gender, balance size, lifecycle stage, product type, investment choice, occupation-type as examples.

APRA is clear that products which perform well in terms of net returns alone may still not deliver quality outcomes to all members within that product[2].

As an example, take the account-based pension being sold to a member whose objective is to produce income for life. As actuaries, we know that half of the fund’s members will live beyond their life expectancy. The longer living cohort (i.e the healthier and/or luckier ones) will get a worse outcome from an account-based pension than if they invest in a lifetime pension* which earns the same investment performance.

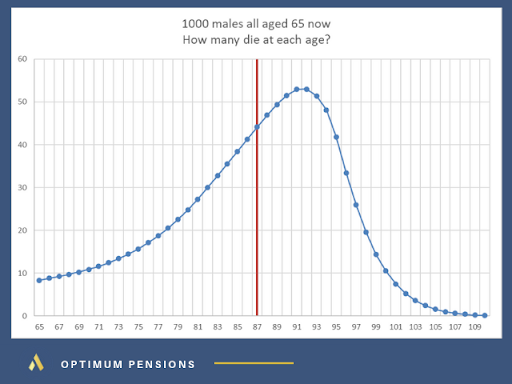

Consider the chart below. It shows how many of a group of 1,000 male members currently aged 65 are expected to live to each future age. The members to the right of the red line (average life expectancy) would get a better outcome if their super fund offered a longevity protection feature. In fact, SIS Act sections 52(11)(a) and 52(7)(a) seem to require funds to offer a longevity insurance feature to be acting in the best interests of their longer living half of members.

The APRA member outcomes standards come into force from 1 January 2020 and will require an annual performance review.

A pure account-based pension is simply not in the best interests of the longer living cohort of members – given that longevity protection insurance is available as a feature and the member can stay in their preferred investment option.

[1] Comments from Deputy Chair, Helen Rowell

[2] https://www.apra.gov.au/sites/default/files/response_to_submissions_-_proposed_revisions_to_sps_515_august_2019.pdf page 5[/vc_column_text][vc_column_text]

***

The Optimum Pensions Real Lifetime Pension is an investment linked lifetime income stream where the assets stay in investment options managed by the superannuation fund but longevity risk is transferred to a global reinsurer. Find out more Real Lifetime Pension.