THE MISSING PIECE:

Longevity Awareness and your Retirement Plan.

What would you consider the principal elements of retirement planning? Deciding when to retire, understanding your sources of retirement income, eligibility for the age pension, managing expenses, knowing which products are offered by your superannuation fund, and your desired retirement lifestyle and spending needs. A critical component is often missing—understanding how long to plan for.

When releasing the 2023 edition of the TIAA Institute GFLEC Personal Finance Index, Surya Kolluri, head of the TIAA Institute, pointed out that, “If you don’t have a realistic understanding of how long you are likely going to live, you are missing one of the most foundational components of any plan: a time horizon”.

“If you don’t have a realistic understanding of how long you are likely going to live, you are missing one of the most foundational components of any plan: a time horizon”. ~ Surya Kolluri

In a recent discussion paper, the Australian Government called on superannuation funds “to do more to understand their members’ retirement needs” and “to enable members to make the mindset shift necessary to confidently draw down on their superannuation in retirement.”

Considering a member’s retirement time horizon should be the foundation of any retirement plan—and not just an average one but a realistic time horizon for the member. Often, that foundational component is the one that is most likely to be missing.

The importance of longevity literacy

“Longevity literacy” or “longevity awareness” is an understanding of how long people tend to live in retirement.

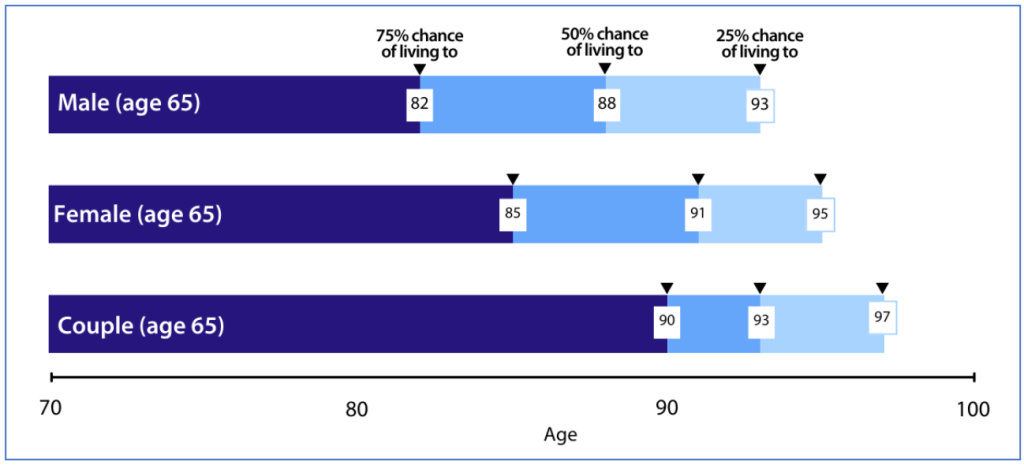

A recent survey by YourLifeChoices revealed that Australians tend to have poor longevity literacy. The survey respondents expect a 65-year-old male to have a life expectancy of just 82 years and a 65-year-old female 85 years.

Compare these results to estimates based on the latest Australian Life Tables produced by the Australian Government Actuary, which calculates improvements in life expectancy over the past 25 years. These provide a more realistic picture.

Chart 1: Life Expectancy at age 65

What does this mean for superannuation fund trustees?

Wharton Professor Olivia Mitchell and her co-authors revealed in their 2022 article “Testing Methods to Enhance Longevity Awareness” that “good consumer financial decision-making requires people to have a clear idea of their life expectancy and longevity risk so as to… decumulate thoughtfully and avoid running out of money in old age.”

A superannuation fund’s retirement income strategy must address how the trustee will assist its members approaching retirement. Given the research quoted above, a good starting point might be to consider helping members improve their longevity literacy. Trustees need to understand how their members perceive and use their chances of living a long time to make retirement decisions.

This means helping members consider the spread of possible future lifespans, not just the average, and consider an individual’s circumstances as much as possible. It won’t be surprising that very few individuals die exactly at their expected lifespan.

Embracing longevity awareness isn’t just about reducing risks; it’s about improving the quality of life for individuals throughout their retirement.

So, what can trustees do to help improve the longevity awareness of their members? A good starting point would be to help members understand two key numbers as they approach retirement: how many more years they are likely to live and the probability of living much, much longer.

Providing members with information about longevity can improve their decision-making.

Helping raise longevity literacy

One tool trustees can use to help their members improve their longevity awareness is the Optimum Pensions Lifespan Calculator, which we designed to help answer the big question in retirement planning: How long should my retirement income last?

Superannuation funds can use the Lifespan Calculator to help their members estimate their personal expected lifespan and possible retirement planning horizon. The calculator considers a range of personal factors and provides the results as a range of possibilities.

We addressed longevity risk in a recent article: “Why You Will Live Longer Than You Think”. Getting life expectancy right and understanding how long we will live—and making sure we have enough retirement funds to last the distance—might be one of the most significant risks in retirement.

Challenger’s submission to the Government’s discussion paper on Superannuation in the Retirement Phase calls for “a national education and awareness campaign to shift Australians’ mindset from building a ‘nest egg’ to providing a regular income in retirement, ensuring Australians are properly informed on the retirement income choices available”.

Longevity literacy is the foundation of retirement planning. Any national campaign aimed at shifting the mindset should include longevity awareness.

“If we can improve people’s longevity literacy, we can help create better retirement plans and increase their confidence.” Surya Kolluri, Head of the TIAA Institute.

Authors: Stephen Huppert & David Orford