The Longevity Conversation: The Missing Link in Retirement Advice

In the complex landscape of retirement planning, one question towers above all others: “How long will my money need to last?” Yet remarkably, this critical component is often the missing piece in retirement planning. At Optimum Pensions, we believe this represents the single greatest gap in current retirement planning frameworks.

The Missing Piece in Knowing Your Client

Financial advisers meticulously document client assets, income needs, investment preferences, and risk tolerances. But when it comes to longevity planning, many rely on standardised assumptions rather than personalised assumptions for each client. This approach overlooks a fundamental component of truly knowing your client.

Longevity risk—the possibility of outliving one’s savings—represents one of the greatest threats to retirement security. Yet clients are rarely asked directly about their comfort level with this uncertainty or their preferred confidence threshold for lifetime income sustainability.

The Question Every Adviser Should Ask

We propose that every retirement planning conversation should include this pivotal question:

“What level of confidence do you want that your retirement income will last your entire lifetime?”

This simple question opens the door to meaningful dialogue about longevity risk and empowers clients to make informed decisions about their financial future. However, before clients can meaningfully answer this question, advisers must provide context about longevity realities and the inherent trade-offs between income levels and planning horizons.

Marie’s Journey: A Practical Example

Let’s follow Marie, a healthy 65-year-old woman planning retirement alongside her 65-year-old partner. Under the current ASIC Regulatory Guide RG 276, a retirement calculator using a single planning period must default to age 92 or five years beyond the current age (whichever is higher).

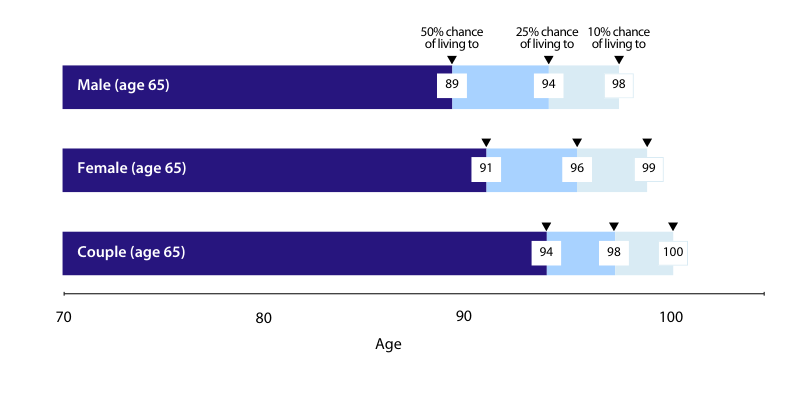

Figure 1 shows the traditional probabilities of survival for Marie and her partner. How useful is this standardised approach for Marie’s unique situation? If Marie’s financial adviser simply followed RG 276 and used age 92, there would be a 65% chance that at least one of Marie or her partner will outlive the planning period.

Figure 1: Life Expectancy at age 65

Note: Ages rounded to the nearest year Source: Australian Life Tables 2020 -22 with 25-year improvement

Step 1: Longevity Education

Marie’s adviser begins by helping her understand potential lifespans based on the range of possibilities in the Australian Life Tables. Rather than focusing solely on life expectancy (which represents only a 50% probability), the adviser discusses the range of possible outcomes:

- 50% probability (life expectancy): The age at which half of people with similar characteristics will have passed away

- 25% probability: The age that one in four people with similar characteristics will surpass

- 10% probability: The age that one in ten people with similar characteristics will exceed

This framing helps Marie grasp the considerable uncertainty around individual longevity and the importance of planning beyond simple averages.

Step 2: Personalised Longevity Assessment

Using the Optimum Pensions Lifespan Calculator, Marie and her adviser input her personal health information to generate tailored survival probabilities. These personalised projections often extend two years beyond standard Australian Life Table figures, providing a more accurate picture of her potential longevity.

More importantly, the calculator illustrates not just individual survival probabilities but also the likelihood that at least one member of the couple will survive to various ages—a critical planning consideration that dramatically extends the planning horizon.

Step 3: Translating Probabilities to Confidence Levels

Next, Marie’s adviser reframes these probabilities as “confidence levels” for retirement planning. This translation makes abstract statistical concepts more relevant to practical planning decisions and helps Marie feel confident about her retirement journey.

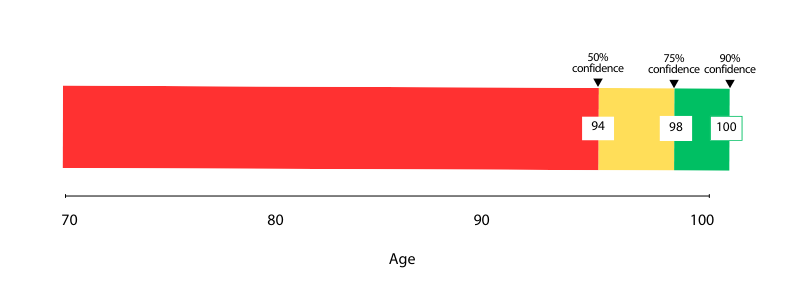

The Optimum Pensions Lifespan Calculator shows that for Marie:

- To be 50% confident, she should plan for her retirement to last for 29 years (to age 94)

- This means: “Your suggested planning horizon is to age 94. There is a 50% chance you may live longer than this.”

- To be 75% confident, she should plan for 33 additional years (to age 98)

- This means: “Your suggested planning horizon is to age 98. There is a 25% chance you may live longer than this.”

- To be 90% confident, she should plan for 35 additional years (to age 100)

- This means: “Your suggested planning horizon is to age 100. There is only a 10% chance you may live longer than this.”

By presenting longevity in these concrete terms, Marie can better grasp what each confidence level means for her personal retirement journey. This clarity transforms abstract probabilities into actionable planning horizons that directly inform financial decisions.

We show planning period confidence level for Marie and her partner in Figure 2 below.

Figure 2: Planning period confidence level for a Couple retiring at 65

Note: Ages rounded to the nearest year Source: Australian Life Tables 2020 -22 with 25-year improvement

Marie now understands that the standard planning age 92 offers only a 35% confidence level for someone with her and her partner’s characteristics—a realisation that gives her pause.

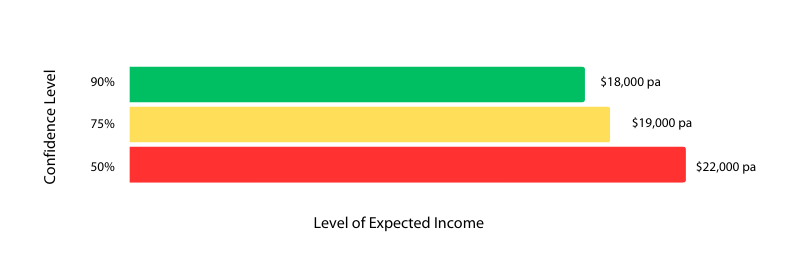

Step 4: Illustrating the Income Trade-offs

Marie’s adviser demonstrates how different confidence levels impact sustainable income streams. By showing how stretching resources across longer planning horizons necessitates moderation in annual withdrawal rates, the adviser helps Marie understand the practical implications of her confidence choice. The chart in Figure 3 is an example of what that might look like (using illustrative income levels only). A financial adviser might use a chart like this to illustrate the trade-off between confidence level and expected income.

Figure 3: Trade-off between confidence level and expected income using Account Based Pension (illustrative income only)

Step 5: Documenting Client Preference

Marie’s adviser then asks, “What level of confidence would you like that your retirement income will last your entire lifetime?”

After considering the trade-offs, Marie selects the 75% confidence level (planning to age 98). This choice reflects her personal balance between income desires and security needs—a fundamentally personal decision that only she could make once properly informed.

Marie’s adviser documents this 75% confidence preference in her Record of Advice, creating a cornerstone reference point for all future retirement planning decisions.

Implementing the Longevity Conversation in Your Practice

For financial advisers seeking to enhance their retirement planning approach, we recommend:

- Integrate longevity discussions into your standard planning methodology

- Utilise retirement calculators that allow for different confidence level inputs

- Present comparative outcomes showing trade-offs between expected income and confidence levels (ideally at 50%, 75%, and 90%)

- Ask clients the question – “What level of confidence do you want that your retirement income will last your entire lifetime?”

- Document client confidence preferences in their Client Record of Advice

By systematically addressing longevity risk and client preferences, advisers create more transparent, personalised, and ultimately more valuable retirement planning outcomes. This approach transforms what was once a standardised assumption into a client-directed decision point, enhancing the quality of advice and client engagement.

The Path Forward

At Optimum Pensions, our vision is for all Australian retirees to achieve secure, sustainable living standards throughout retirement, regardless of longevity. We believe the Longevity Conversation represents an essential step toward this goal—empowering clients to make informed decisions about one of retirement’s most significant uncertainties.

By transforming retirement through innovation, education, and acceleration, we’re creating clearer pathways to improved longevity literacy and risk management. When advisers engage clients in meaningful discussions about confidence levels and planning horizons, they address the fundamental but often missing piece in comprehensive retirement advice.

The result? More engaged retirees, better-equipped advisers, and retirement plans truly tailored to individual needs and preferences—no matter how long the journey lasts.

—

To learn more:

Try the Lifespan Calculator

Read articles: